While challenges linger from the 2025 offshore rig market, there are signs it will look brighter from late 2026 onwards.Main Events of 2025One of the biggest talking points of 2024 and 2025 was Saudi Aramco’s suspension of 36 jackups from April 2024, but by 3Q 2025 21 units had been re-deployed into other regions of the world. Fast forward to today, the national oil company (NOC) has confirmed it will restart work with eight of the remaining suspended rigs in early 2026…

Noble Corporation’s recent decision to sell the Pacific Meltem and Pacific Scirocco for non-drilling purposes highlights a key issue in the drillship market: What happens to cold-stacked rigs that are unlikely to return to work? With the floater…

After what we would argue has been an incredibly eventful 2024 with massive deals, tremendous dayrate developments, further charterer backlog build, and the first series of newbuild orders in years, now comes the time when we turn our gaze towards 2025…

Saudi Aramco’s ambitious post-Covid jackup fleet expansion program, in which the operator looked to increase its fleet size from approximately 49 jackups in June 2022 to 90 in just two years, seemed a daring feat. But fast forward to March 2024…

The specialized deepwater oil & gas and floating offshore wind segments will share many of the same stakeholders and supply chains, competing for increasingly scarce resources.To receive a full version of Inteletus analysis, click hereThe established…

Global jack-up marketed utilization has been on an upward trajectory since 2017, reaching its peak of 94% at the end of 2023. However, the outlook for the year ahead looks somewhat flat, though there is still time for new demand.The North Sea jack-up market has improved year-on-year since 2017…

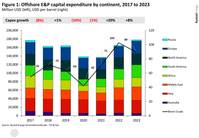

Offshore exploration and production (E&P) capital expenditures (capex) will shake off the pandemic-induced declines of the past two years and rebound by 20% in 2022, reaching a total $165 billion spent on exploration, wells, and facilities (Figure 1)…

Oil prices fell by 4% on Monday, extending last week's steep losses on the back of a rising U.S. dollar and concerns that new coronavirus-related restrictions in Asia, especially China, could slow a global recovery in fuel demand.A United Nations…

Demand for work-class ROVs (WROV) has traditionally been determined by the state of the global offshore oil & gas industry. This is likely to remain the case in the short to medium-term. However, there’s a new kid on the block – offshore wind…

Oil rose for a fourth straight session on Wednesday as the market shrugged off an industry report showing U.S. crude stockpiles rose more than expected, extending a rally driven by hopes that a COVID-19 vaccine will boost fuel demand.Brent crude was up 30 cents…

AOG Digital E-News is the subsea industry's largest circulation and most authoritative ENews Service, delivered to your Email three times per week