2024 has been another strong year for the offshore drilling rig market with high utilization and dayrates. However, the winds of change have started to blow, and the market is already showing some signs of weakening demand and declining dayrates across the three main rig types – jackups, semisubs and drillships. Inflationary pressures across the sector are the driving force of the market correction we expect to see in 2025.

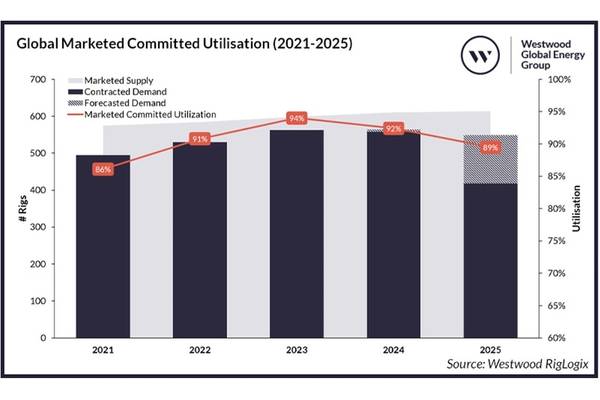

Westwood expects full-year 2024 marketed committed utilization, which considers actively marketed rigs with charters underway or already booked with future start dates, to come in around 92%. This is down from 94% in full year 2023 but is still a strong rate indicating tight rig availability. For 2025, Westwood is forecasting a lower marketed committed utilization rate of 89%, with the semisub market to be the hardest hit of the three rig types.

Westwood’s top three predictions for 2025 are that there will be a slowdown in global rig demand, a pickup in rig attrition, and downward pressure on dayrates.

1.Slowdown in rig demand, but Global South to dominate going forward

By the second half of 2024, signs of slowing demand were already being felt, as several projects with pending final investment decisions were pushed out, and drilling campaigns with tentative start dates in late 2024 and early 2025 were delayed. Given that we are seeing demand delays rather than demand destruction through project cancellations, is an indicator that the market is entering a correction phase and the upcycle continues. Rising projects costs, of which rig dayrates are only one part, are one of the main contributing factors, along with delays caused by supply chain challenges resulting in long lead-times for parts and equipment. In some cases, field development components have been delayed to the point that the timing for the related development drilling also needs to be postponed until the components are ready to go.

While the slowdown in demand is being felt worldwide, the decline is not as steep in the Global South, which is a loose grouping of countries considered to be “developing”, many of which are located in the Southern Hemisphere. Going forward, offshore rig demand is expected to grow in areas such as Latin America, Africa and India, offsetting some of the demand loss in locations like the North Sea more recently, and the US Gulf of Mexico shallow-water shelf, which has been on the decline for many years. This is in line with expected global energy demand expectations. South America will continue to lead global floating rig demand, and the Middle East will remain the dominant driver of jackup demand.

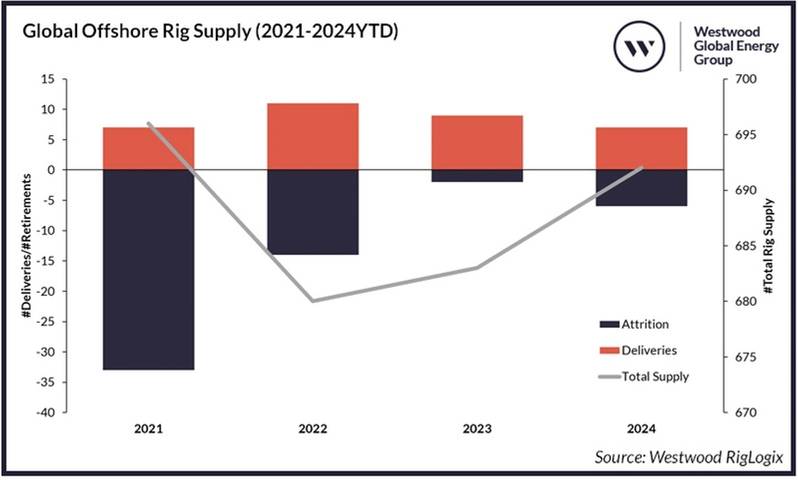

2.Rig attrition will pick up, particularly for semisubs

The drop in offshore rig demand will then lead to an increase in attrition decisions. Westwood expects the semisub segment to lose the most of the three rig types next year, as this rig segment continues to fall out of favor in most floating rig regions, with the exceptions being the North Sea and Australia, where semisubs are preferred over drillships. As the end of 2024 nears, six semisubs have been retired already this year. None have been delivered, resulting in a net decrease for this rig type. Conversely, in 2024, no drillships or jackups have been retired. Instead, four drillships and four jackups have been delivered, yielding a net increase in both fleets.

Rig contractors will focus their cuts on units with the least likelihood of finding future work. Projected high reactivation or upgrade costs is also a factor that will be considered. Recent and likely forthcoming consolidation among rig contractors should also provide the opportunity to streamline the combined fleets and retire any units not part of the company’s go-forward fleet. Source: Westwood RigLogix

Source: Westwood RigLogix

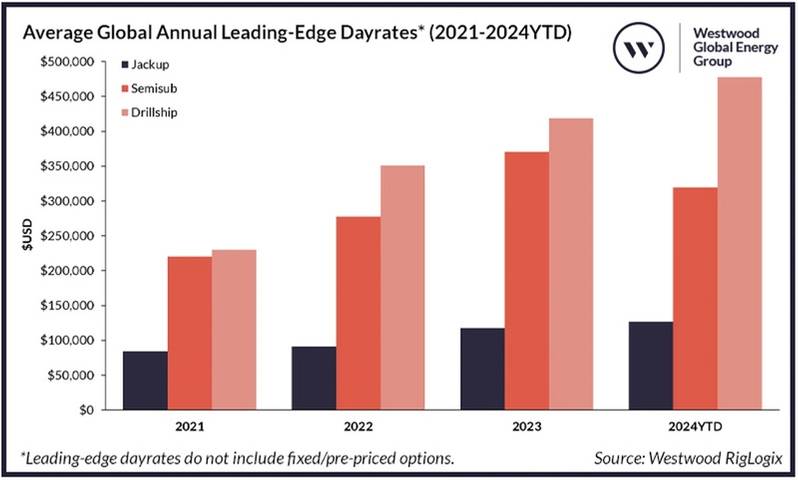

3.Leading-edge dayrates will decline

2024 brought some additional clean (that is, excluding additional items such as MPD or integrated services) floating rig rates above $500,000 per day, as well as the first rate recorded during this cycle over $600,000, which was for an 8th generation drillship to conduct high-specification 20K project work in the US Gulf of Mexico. However, Westwood is already seeing signs of leading-edge dayrates declining as whitespace has started appearing on late 2024 and 2025 schedules across rig types.

With semisubs being the first rig type to show demand softness this year, they have kicked off the declining dayrate trend, as the 2024 average is down about 14% from 2023. Meanwhile, the demand weakness we are seeing for jackups and drillships is showing up closer to the end of the year; therefore, both will record 2024 average leading-edge dayrates above their 2023 averages, with jackups up about 8% and drillships up around 15%. Source: Westwood RigLogix

Source: Westwood RigLogix

As bidding becomes more competitive, dayrates are increasingly under pressure, as rig contractors push to keep their active fleets working. Expect to see more incentives offered, such as lower mobilization fees and discounted minor upgrades. However, do not expect dayrates to crash as low as they did during the previous prolonged downturn. This time, inflation plays a factor, with much higher labour, service and parts costs. This means rig contractors will not be able to discount their dayrates as much as before, and we may see some rigs forced into cold stack if they cannot find work quickly enough to warrant keeping the rig marketed and fully or partially crewed. Meanwhile, dayrates for the highest-capability units will continue to command the highest end of the dayrate ranges, as these units also face the least availability in the near-to-medium term.

The aforementioned attrition and Westwood’s expectation for few deliveries next year will tighten the available rig supply even further. Once operators begin to jump on the lower dayrate offers, thereby reducing near-term availability, then dayrates will bottom out and start to rise once again. With drilling demand generally being pushed into 2026-27 instead of cancelled, this sets the stage for 2025 to be a year of declining demand and dayrates as part of a market correction in a continued upcycle rather than the beginning of another downturn.

AOG Digital E-News is the subsea industry's largest circulation and most authoritative ENews Service, delivered to your Email three times per week