The pace at which crude oil flowed into China's stockpiles increased in April as slower refinery processing outweighed a decline in imports.A total of 830,000 barrels per day (bpd) was added to China's commercial or strategic stockpiles in April, up from 790,000 bpd in March, according to calculations based on official data.Over the first four months of the year, China, the world's biggest crude importer…

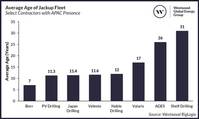

While utilization for marketed jackup rigs is at a healthy 100% in the Asia Pacific (APAC) region, it is an ageing fleet that will ultimately be unable to fulfil operator age requirements.Westwood’s RigLogix records 39 marketed jackups in APAC…

The offshore support vessel (OSV) market is very much a global industry where ships frequently mobilize between regional markets. This offers far more opportunities than markets more closely linked to their specific local geography and operational patterns…

Examining similarities and differences between the deepwater oil & gas and the emerging floating wind segment.There has been much excitement around the potential for the offshore wind industry to access deeper water sites through the deployment of floating wind technology…

At a high-level, there are three solutions to transferring technicians from shore bases to offshore wind farms for construction and O&M activities: crew transfer vessel (CTV), helicopter, and SOVs/CSOVs.SOVs and CSOVs generally house 60-120 technicians offshore for a few weeks at a time…

China and India lifted imports of seaborne thermal coal to three-month highs in March as the world's two biggest buyers took advantage of lower international prices of the fuel to meet strong domestic power demand.China, the world's biggest coal producer and importer…

Asia's imports of crude oil are expected to rise to the highest in 10 months as heavyweights China and India lifted arrivals from Russia, but impending maintenance schedules and rising prices mean such levels may not be sustained.The world's top importing region is forecast to see arrivals of 27…

India's petroleum consumption climbed to a new record last year and the country is on course to overtake China as the primary driver of incremental oil consumption before 2030.Urbanisation, industrialisation and the growth of the middle class…

More than 100 countries at the COP28 climate summit in Dubai have agreed to triple renewable energy capacity by 2030 - one of the least controversial commitments floated at the conference.But they have given little detail on how they can make an industry running flat out go that much faster…

Investors are increasingly pessimistic about the outlook for crude oil prices as doubts grow OPEC+ will cut production enough to offset rising non-OPEC output and a deteriorating economic outlook.But many professional money managers are more optimistic about refined fuel prices…

A surge of diesel and gasoline exports from China in the last northern winter eased then-prevailing fuel shortages in Asia but a repeat performance this year is unlikely.China's exports of refined products have eased from high levels in recent months…

Thailand has jumped from eleventh to eighth in the world ranking for imports of liquefied natural gas (LNG), after purchases through October soared 25% from the same period in 2022.Thailand imported 22.9 million cubic metres (MCM) of LNG through October…

Pakistan is unlikely to meet a target for Russian crude to make up two-thirds of its oil imports, despite attractive prices, hampered by a shortage of foreign currency and limitations at its refineries and ports, officials and analysts say.The…

A Liberian-flagged oil tanker set sail in May from Russia's Ust-Luga port carrying crude on behalf of a little-known trading company based in Hong Kong. Before the ship had even reached its destination in India, the cargo changed hands.The new owner of the 100…

Australia's threat to curb exports of liquefied natural gas (LNG) in order to ensure domestic supplies is another unwelcome pressure on a tight global market for the super-chilled fuel.But it's not an immediate threat, and it may also not materialize at all…

AOG Digital E-News is the subsea industry's largest circulation and most authoritative ENews Service, delivered to your Email three times per week